Avoid Costly Mistakes: Tips for Medicare and Medicare Advantage Eye Care Billing

/Ophthalmology and optometry practices with a large Medicare and Medicare Advantage patient base face unique billing challenges, but also opportunities to streamline patient care, reduce denied claims, and improve patient satisfaction.

However, overlooking key billing processes may lead to costly mistakes and reduced cash flow. In this blog, we discuss a client case study and review critical Medicare and Medicare Advantage billing dos and don’ts to help your eye care practice succeed and boost net collections.

Optometry Practice Case Study: Reviving Cash Flow

Our Fast Pay Health team identified a pattern of denied Medicare Managed Care Organization (MCO) and Medicaid MCO claims for a one-location, one-doctor optometry practice in Tennessee that began using our services in November 2024. Here’s a snapshot of the case challenge and ROI solution we implemented to expedite reimbursements and improve cash flow in the first year.

CHALLENGE: Reduce Frequent Claim Denials

Medicare MCO and Medicaid MCO claims are a significant component of this practice's revenue, as they provide services to a large nursing home patient base (short- and long-term). The practice was experiencing frequent denials and a significant decline in cash flow before it started using Fast Pay Health services.

ROI SOLUTION: Increase Monthly Cash Flow

Fast Pay Health immediately implemented a patient eligibility and benefits verification process to identify MCO plans for Medicare and Medicaid before the patient visit. This drastically reduced denials in the “covered by another payer” scenario.

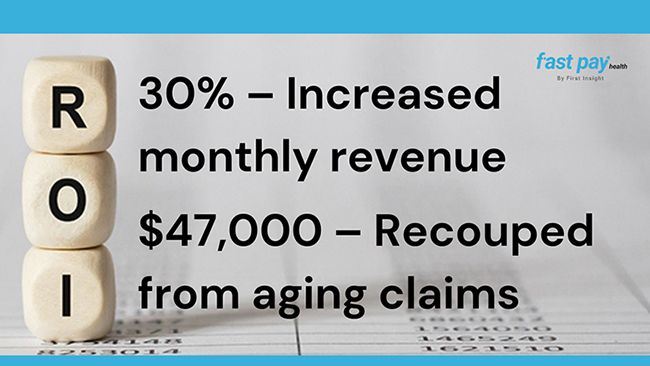

In addition, the Fast Pay Health accounts receivable (AR) team proactively addressed aging and denied claims (within the timely filing limits) and processed the claims with the correct payers. This proactive approach resulted in:

Increased monthly revenue by 30% from $17,000 to an average of $22,000 within the first year.

Recouped $47,000 from insurance payers by auditing and resubmitting older claims.

Medicare and Medicare Advantage Eye Care Billing Best Practices

Verify the patient’s insurance eligibility every time. Medicare Advantage plans change frequently and often have unique rules for prior authorization and billing. Confirm coverage and authorization before every visit—even for established patients. Some patients may not even realize they are enrolled in a Medicare Advantage plan and may only provide you with their Medicare Beneficiary Identifier (MBI) card.

Automate insurance eligibility verification and pre-auth workflows. An AI-driven billing assistant like EVAA can make a huge difference in keeping your revenue cycle management running smoothly and preventing denied claims. Many patients have additional vision coverage through another managed vision care (MVC) plan that they may not be aware of. A quick eligibility check saves time, since Medicare maintains a record of reported “crossover plans,” including supplemental coverage or vision insurance.

Follow CMS rules when billing Medicare Advantage plans. Medicare Advantage plans are an “all-in-one” alternative to traditional Medicare, offered by private insurance companies. Medicare approves all Medicare Advantage plans and requires them to comply with CMS rules for coding, billing, claim submission, and reimbursement. Medicare Advantage plans follow Medicare guidelines.

Use the MBI when billing Medicare. Always check your patient’s Medicare card and verify that the patient's name and address are correct. If your information on file differs from the Medicare address you receive in electronic eligibility transactions, ask your patient to contact Social Security to update their Medicare records.

Confirm the Medicare Part B annual deductible has been met. If you “accept assignment” for Medicare Part B, CMS recommends that you not collect the deductible from a patient until you receive the Medicare Part B payment, or you have confirmed the deductible has been met for the year.

Note the co-insurance amount you collect for the covered service on the claim form. If you over-collect, CMS may consider this program abuse, and it may result in part of the provider’s check being sent to the beneficiary on assigned claims. Or, if Medicare Part B determines that they overpaid you, the Medicare Administrative Contractor (MAC) will send you a demand letter outlining the repayment request.

Clarify non-covered services. Services such as refractive surgery or advanced lens upgrades during cataract surgery may not be covered.

Know when to use an ABN form. An Advance Beneficiary Notice of Noncoverage (ABN) is an informed consent document that informs the patient they may be financially liable for costs if their insurance carrier denies the claim. Failure to obtain a signed ABN form before providing the procedure or service could result in being unable to bill the patient or get paid for non-covered services.

Document like a pro. Always ensure your clinical documentation supports the CPT® code billed. Keep accurate records documenting the specific Evaluation and Management (E/M) service (a category of CPT® codes used for billing) the patient received for the treatment. Include exam findings, medical necessity, and procedure details. If it’s not written, it didn’t happen.

Use modifiers correctly. Modifiers like -25, -59, and -RT/LT can make or break a claim. Know when to use modifiers—and when not to. Incorrect use can trigger audits or denials.

Review common coding denials and adjustment reasons. Claim denials fall into three categories: administrative, clinical, and policy. Most claim denials are due to administrative errors. For example, the procedure code is inconsistent with the modifier you used, or the required modifier is missing for the decision process (adjudication).

Be diligent with LCD and NCD guidelines. To ensure you are coding your eye care claims correctly, be diligent with CMS Local Coverage Determinations (LCD), National Coverage Determinations (NCD), and Medicare Administrative Contractors (MAC).

Medicare and Medicare Advantage Eye Care Billing Mistakes to Avoid

Don’t confuse Medicare Advantage plans with Medicare. If a patient has a Medicare Advantage plan, do not bill traditional Medicare. Medicare Advantage plans are not supplemental plans.

Don’t assume all Medicare Advantage insurance plans are the same. Medicare Advantage plans have different rules. Treat each Medicare Advantage payer like its own plan.

Don’t overlook refraction rules. Refractions are often not covered by Medicare. Billing them incorrectly—or bundling them with medical exams—can lead to denials.

Don’t ignore post-op global periods. Billing for routine post-op visits during the global period without proper modifiers is a red flag. Know your timelines.

Don’t upcode or downcode. Billing for a higher or lower level of service than documented can trigger audits or lost revenue.

Don’t rely on old Medicare fee schedules. Medicare updates its rates annually. Using outdated schedules can lead to underbilling or overbilling.

Don’t skip internal audits. Regular chart audits help catch coding errors before payers do. They’re your best defense against compliance risks. Medicare Advantage plans often trigger risk adjustment audits requiring extensive chart reviews.

Don’t let denied claims sit idle. Set up a system to flag, correct, and resubmit them. Many denials are fixable—and appealable—if caught early.

Experience Positive Cash Flow with Fast Pay Health

Researching rejected and denied claims is frustrating. You and your staff can spend hours each week analyzing unpaid claims and EOBs to determine the necessary steps to correct and reprocess rejected and denied claims. Huge aging buckets lead to chaos and less cash flow. Free up your staff’s time and reduce stress with Fast Pay Health’s end-to-end RCM services.

Contact the Fast Pay Health team today to schedule a free RCM consultation and see how we can increase your net collections.

CPT® is a registered trademark of the American Medical Association®.