Mastering Claim Denial Reason Codes Expedites Cash Flow

/Researching and resubmitting denied eye care claims can lead to long, frustrating hours trying to determine what denial and adjustment reason codes mean and what action to take.

Once an eye care practice receives a claim denial, reworking and resubmitting the claim can delay cash flow by 45 to 60 days.

On average, the healthcare industry's claim denial rate is 5–10%, and about two-thirds of denials are recoverable. Nearly 65% of denied claims are never reworked or resubmitted to payers. The good news is that almost 90% of claim denials are avoidable with a proactive optometric billing and RCM solution.

What’s the Difference Between a Rejected Claim and a Denied Claim?

Rejected Claim: A rejected claim has never been processed by a clearinghouse, insurance payer, or the Centers for Medicare & Medicaid Services (CMS). It’s not considered “received” and did not make it through the adjudication (decision process) system.

A rejected claim contains one or more errors and fails to meet specific formatting, optometry billing and coding criteria, and data requirements. Once you fix the errors, you can resubmit the rejected claim.

Related: 6 Eye Care Claim Rejections You Can Overcome

Denied Claim: A denied claim is a claim that made it through the adjudication system. The insurance company or third-party payer received and processed the claim. However, even though a payer denies a claim, you can still appeal it, as that doesn’t mean it’s not payable.

Payers will send you an Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA) that lists why they denied the claim. You must determine why the claim was denied before correcting the errors and resubmitting the claim. That’s why brushing up on claim denial and adjustment reason codes is critical.

Related: 15 Claim Denial Management Solutions to Improve Cash Flow

Three Claim Denial Categories: Administrative, Clinical and Policy

Claim denials fall into three categories: administrative, clinical, and policy—most claim denials are due to administrative errors.

For example, if the procedure code is inconsistent with the modifier you used or the required modifier is missing for the decision process, your claim will be denied. Once you correct the errors, you can resubmit the claim to the insurance payer.

While tracking down why the insurance payer denied the claim in the first place is time-consuming, the longer you wait to determine what went wrong, the more likely you won’t recover the maximum amount (or any) from the insurance payer. Pay close attention to the permitted time frame, as each insurance carrier has its own guidelines.

Common Claim Denial Reasons and Claim Adjustment Codes

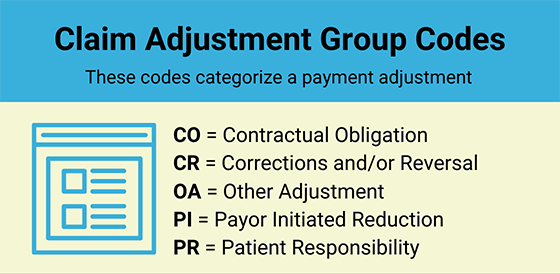

Claim Adjustment Group Codes include two alpha characters that assign the responsibility of a claim adjustment that appears in the Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA): CO, CR, OA, PI, and PR.

These group codes include a numeric or alpha-numeric claim adjustment reason code that indicates why a claim or service line was paid (or not paid) differently than it was billed.

Let’s review common claim denial reason codes and actions you can take to improve your cash flow in your eye care practice.

CO-4: The procedure code is inconsistent with the modifier used or a required modifier is missing. Resubmit the claim using an appropriate modifier for the procedure.

CO-15: Payment adjusted because the authorization number is missing, invalid, or does not apply to the billed services or provider. Resubmit the claims with the authorization number or valid authorization.

CO-45: Charges exceed fee schedule/maximum allowable or contracted/legislated fee arrangement. Use Group Codes PR or CO, depending on the liability. Write off the indicated amount.

CO-50: Non-covered services that are not deemed a “medical necessity” by the payer. To avoid coding denials, when you use a CPT® code, you must also demonstrate that it is “reasonable and necessary” to diagnose or treat the patient’s medical condition. Medical necessity is based on “evidence-based clinical standards of care.” Check the diagnosis codes or bill the patient.

CO-97: The payment was adjusted because the benefit for this service is included in the payment/allowance for another service/procedure that has already been adjudicated. Resubmit the claim with the appropriate modifier or accept the adjustment.

CO-167: The diagnosis (es) is (are) not covered. Review the diagnosis codes(s) to determine if another code(s) should have been used instead. Correct the diagnosis code(s) or bill the patient.

CO-B16: Payment adjusted because the new patient qualifications were not met. Resubmit the claim with the established patient visit.

OA-23: Indicates the impact of prior payers(s) adjudication, including payments and/or adjustments. No action required since the amount listed as OA-23 is the allowed amount by the primary payer.

OA-109: Claim not covered by this payer/contractor. You must send the claim to the correct payer/contractor. Review coverage and resubmit the claim to the appropriate carrier.

PR-1: Deductible amount. Bill to secondary insurance or bill the patient.

PR-2: Coinsurance amount. Bill to secondary insurance or bill the patient.

PR-3: Copay amount. Bill to secondary insurance or bill the patient.

Coding Denial Management Pro Tip: Create a claim denial reason and adjustment code at-a-glance checklist that includes the Claim Adjustment Group Codes, Reason, and Action for common claim denials.

Claim Denial Reason Codes Resources

Reason Statements and Document (eMDR) Codes: If your office submits claims to multiple CMS contractors, it’s crucial to stay on top of denial codes and statements.

Claim Adjustment Reason Codes (CARCs): These codes indicate the reasons for payment adjustments and describe differences in payment from the billed amount for the claim or service line.

Remittance Advice Remark Codes (RARCs): These codes provide additional details regarding an adjustment already specified by a Claim Adjustment Reason Code or convey information about processing remittance.

Case Study: Collaborative Denial Management Captures Lost Revenue

Fast Pay Health optometric billing consultants identified a pattern of denied claims for a three-doctor, one-location optometry practice in California. Here’s a snapshot of the case challenge and ROI solution Fast Pay Health put in place to expedite reimbursement for denied claims from 45–60 days to 15 days.

Challenge: Not Using Correct Diagnosis Code: The CPT® procedure code submitted on the claim was denied because of an invalid diagnosis code. For example, the practice often performs a Scanning Computerized Ophthalmic Diagnostic Imaging (SCODI) to evaluate and treat patients with retinal disease or macular abnormalities.

In this patient case, specific ICD-10-CM diagnosis codes can be used with the CPT® code 92133. However, the claim was denied because the diagnosis code was not within the predefined diagnosis code set issued under the LCD guidelines.

Pro Tip: To ensure your eye care claims are coded correctly, keep up-to-date with the Medicare Administrative Contractors (MAC) in your region. MACs will often issue Local Coverage Determination (LCD) and National Coverage Determination (NCD) if a particular item or service is covered.

Solution: Insurance Company Paid $6,500 Denied Claim: The Fast Pay Health certified coders reviewed the patient’s electronic health record and all CPT® codes for the denied claims. The team corrected and resubmitted the denied claims, collecting $6,500 in lost revenue.

Fast Pay Health also created a list of allowed diagnosis code sets for the doctor’s office so they could use the list to avoid future claim denials.

Invest in a Proactive Claims Denial Management Solution

The best revenue cycle management solutions pay close attention to credentialing, eligibility verification, charge entry, coding, and claim submission requirements before you push the “Send” button. Fast Pay Health’s approach is to triple-check everything so that you see a consistent return on investment.

Schedule an introductory phone call today to set up your free practice analysis. Start enjoying the advantages of cleaner claims that focus on improving the financial health of your eye care practice. We work with ANY eye care practice management software.

CPT® is a registered trademark of the American Medical Association®.