Stop Revenue Leaks in Your Eye Care Practice With Fast Pay Health

/You can see patients back-to-back, fit them for glasses and contacts, and keep your schedule full. But when you check your financials, the numbers tell a different story. Cash flow feels tight. Bills get paid late. New equipment has to wait. The problem isn't the number of patients you see—it’s hidden revenue leaking out of your practice through poorly managed accounts receivable (AR).

When we reviewed AR data from 456 eye care practices, the patterns were impossible to ignore. Too much money was sitting in old AR buckets, denial rates were higher than they should be, and follow-up often fell through the cracks. The good news is that practices that partnered with Fast Pay Health, our dedicated revenue cycle management healthcare solution, closed these gaps and saw significant improvements in collections.

Why the Accounts Receivable Aging Report Matters

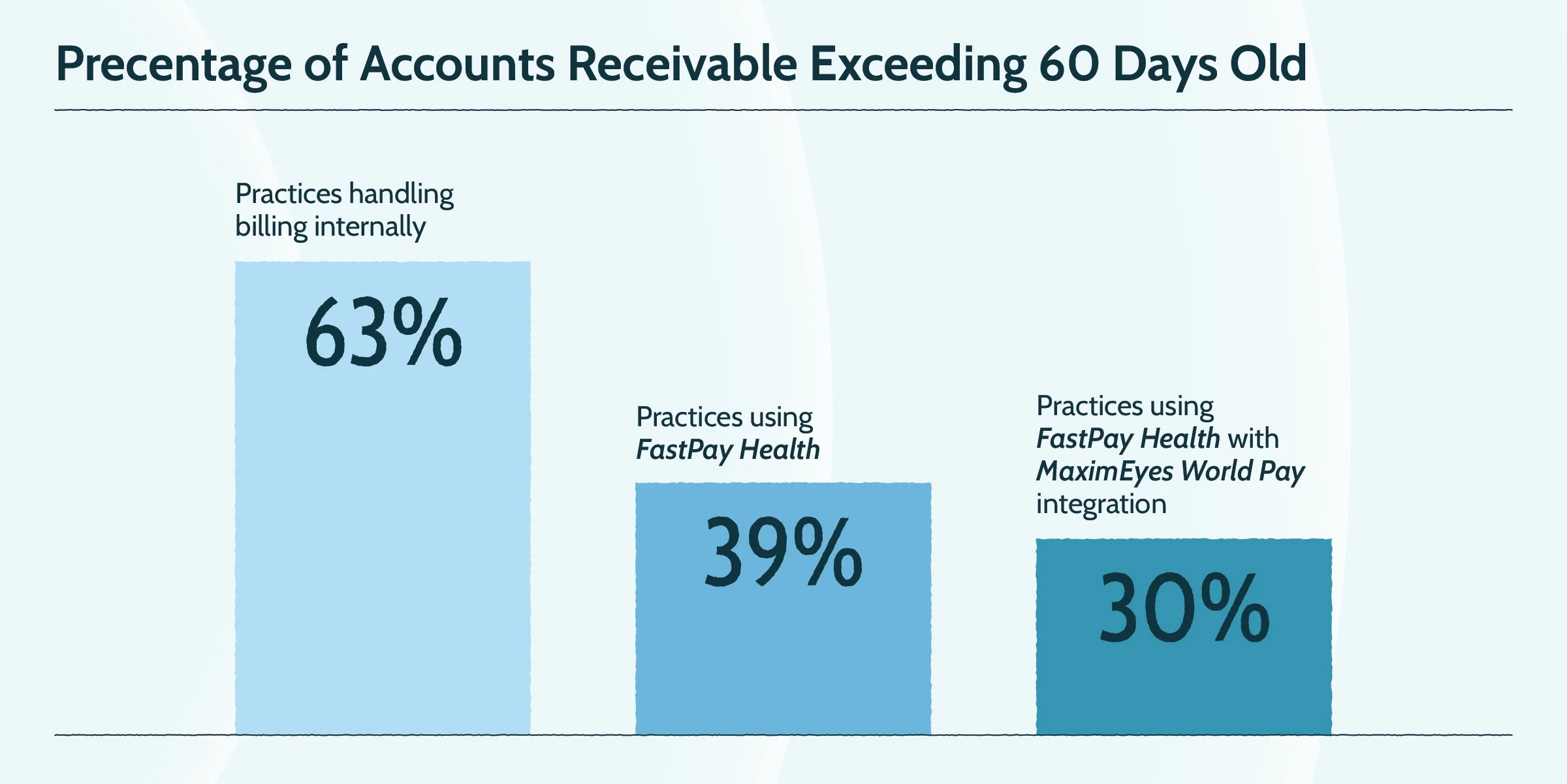

In practices that handled billing internally, 63% of AR sat over 60 days old. That means more than half of the money earned was stuck waiting to be collected. For many practices, those dollars eventually get written off—even though the work has already been done.

The story changed when practices used Fast Pay Health. AR over 60 days dropped to 39%. Practices that also used the MaximEyes Worldpay integration brought that number even lower, down to 30%.

That difference shows up in real ways:

Payroll gets covered without stress.

Equipment purchases no longer have to wait.

Doctors and staff can focus on patients instead of chasing balances

A healthier accounts receivable aging report is the foundation of practice stability.

Turning Denials Into Dollars Collected

Claim denials don’t just slow down payments—they block revenue. In-house billing teams often struggled with double-digit denial rates caused by eligibility errors, coding mistakes, or missed authorizations.

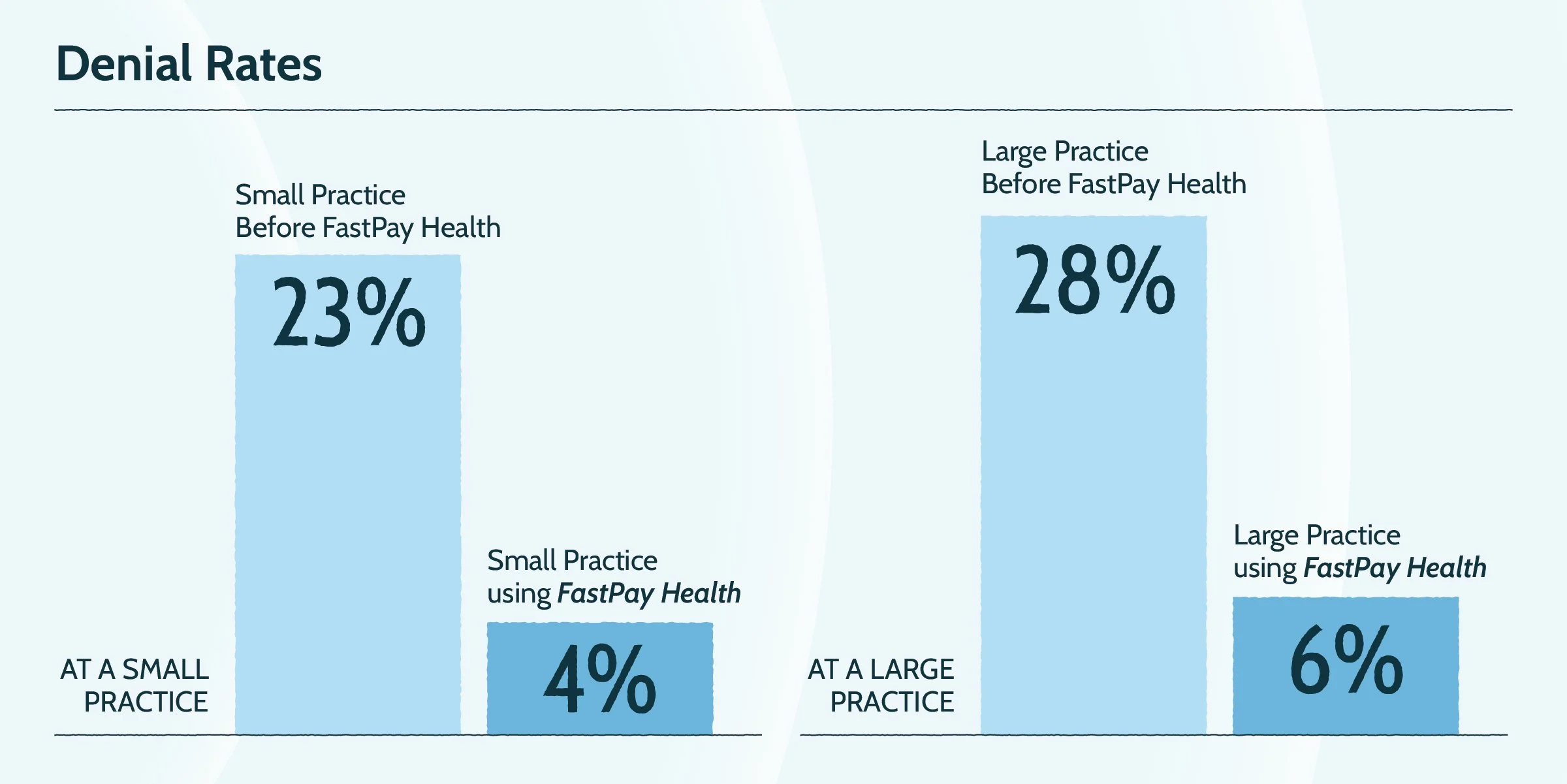

Once Fast Pay Health stepped in, denial rates dropped fast:

A small practice cut denials from 23% to 4%.

A large practice reduced denials from 28% to 6%—a 22-point improvement.

Fewer denials mean fewer headaches for staff and more dollars collected.

Claim Follow-Up: The Make-or-Break Step in Revenue Cycle Management

Even clean claims don’t always get paid on time. That’s why follow-up is critical. But in a busy office, it often falls to the bottom of the list. Staff end up juggling claim calls, payer portals, and paperwork instead of focusing on patients.

Practices that outsourced billing saw measurable improvements:

A small practice got paid 21 days faster.

A medium office improved by 9 days.

A large practice sped things up by 10 days.

When multiplied across dozens of claims per week, that speed adds up to significant cash flow improvements.

Case Studies: How Fast Pay Health Improves AR

Here are real examples of eye care practices that partnered with Fast Pay Health for optometry billing solutions:

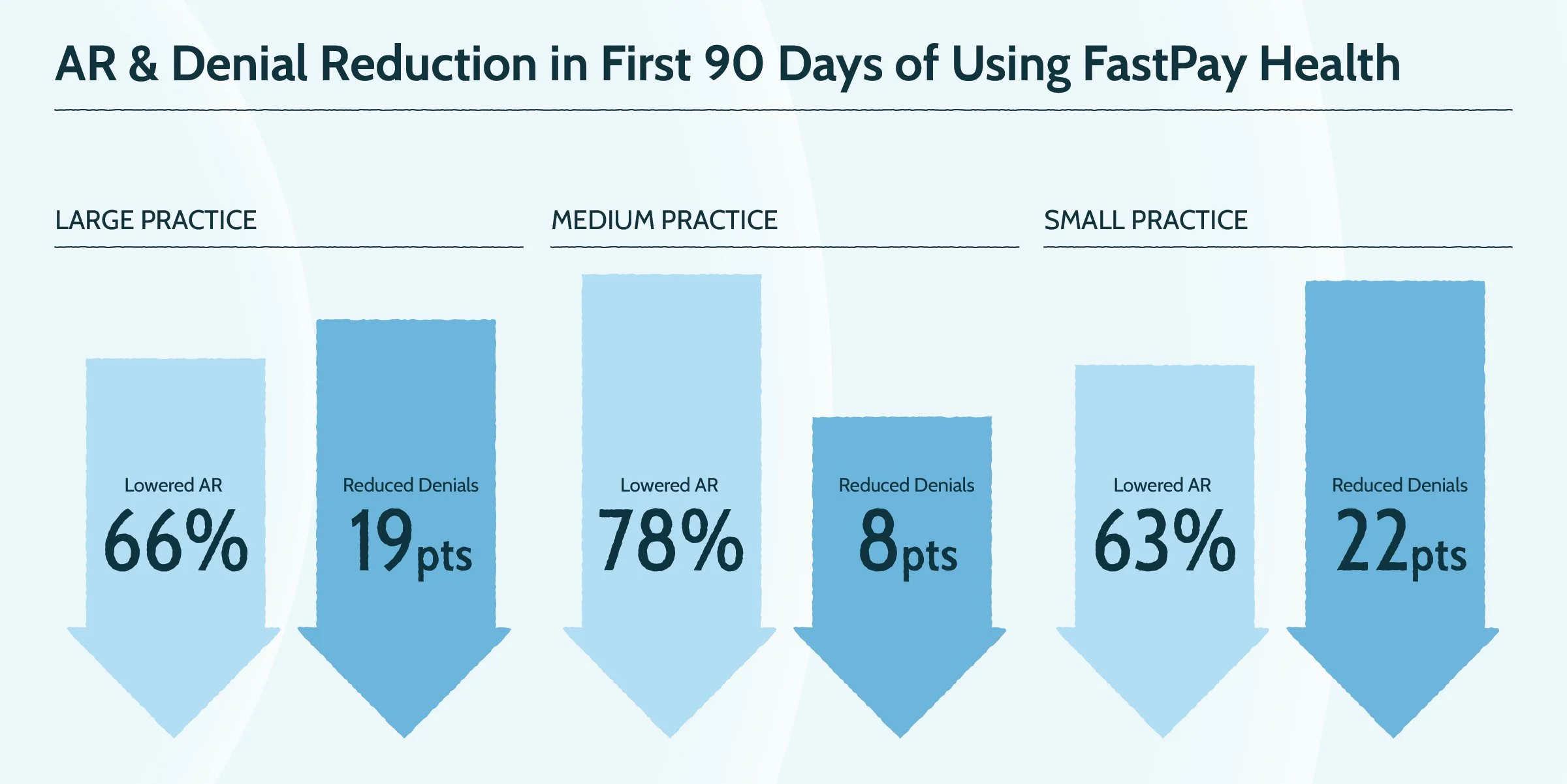

Small practice: Lowered AR over 90 days by 66%, reduced denials by 19 points, and shortened payment time by three weeks.

Medium practice: Cut AR over 90 days by 78%, improved AR days by nearly three weeks, and dropped denials by 8 points.

Large practice: Reduced AR over 90 days by 63%, cut denials by 22 points, and boosted first-pass acceptance rates from 67% to 94%.

These practices didn’t just clean up their AR—they unlocked working capital, improved staff satisfaction, and gave patients a smoother billing experience.

Looking Beyond AR to Stop Revenue Leaks

Doctors often view AR as a monthly snapshot, but it’s really the health of your revenue cycle. When balances sit in old buckets or denials pile up, you’re giving free loans to payers and patients while carrying all the risk.

Fast Pay Health keeps claims clean, follows up quickly, and manages denials before they spiral. With stronger revenue cycle management in healthcare, practices protect the money they’ve already earned. That means less stress and more confidence in financial planning.

And AR isn’t the only place where money slips away. Research shows businesses lose 1–5% of revenue to inefficiencies like manual processes and billing mistakes. In eye care, that could be thousands of dollars every year. Integrated solutions help:

MaximEyes Payments: Shortens checkout and reduces AR days.

Fast Pay Health: Manages complex billing rules and accelerates reimbursements.

MaximEyes Patient Engagement: Reduces no-shows and adds billable appointments.

Together, these tools seal revenue leaks while improving the patient experience.

Take Control of Your Practice Revenue Today

If your accounts receivable aging report shows a large portion of balances past 60 or 90 days, your practice is already losing money. But it doesn’t have to stay that way. Practices that outsourced billing to Fast Pay Health lowered denials, reduced aging AR, and got paid weeks sooner.

Want to see where your practice stands? Fast Pay Health offers a complimentary AR assessment that highlights where revenue is slipping away—and how much you can recover.

Stop letting AR hold your practice back. Take back the revenue you’ve already earned with the right optometry billing solutions for your practice.

Contact the Fast Pay Health team today to schedule a consultation.